Taxes In JapanTaxes in Japan are broken up into two major categories: National Tax and Local Tax. The two main forms of tax are Income Tax "Shotokuzei - 所得税", and residence Tax "Juminzei - 住民税". The rates you pay for both kinds of tax are calculated according to your earnings. Below is the list of general taxes applicable to individuals:

Note: You will be required to file tax returns and make tax payments for special income tax for reconstruction (2.1% of the amount of income tax for each year, in principle) from 2013 through 2037 annually together with income tax of respective years, for securing necessary funds for measures to carry out reconstruction from the Great East Japan Earthquake. Income TaxIn Japan, the income tax is based on the self-assessment system, meaning a person determines the tax amount himself or herself by filing a tax return in accordance with his/her own residential status. This procedure is called the filing of the final return or income tax return. Employees normally do not need to file a tax return, as their employer will have their income taxes withheld from their salary, and when necessary the adjustment is made with the year's final salary. However, employees will need to file a tax return if one of the following conditions applies:

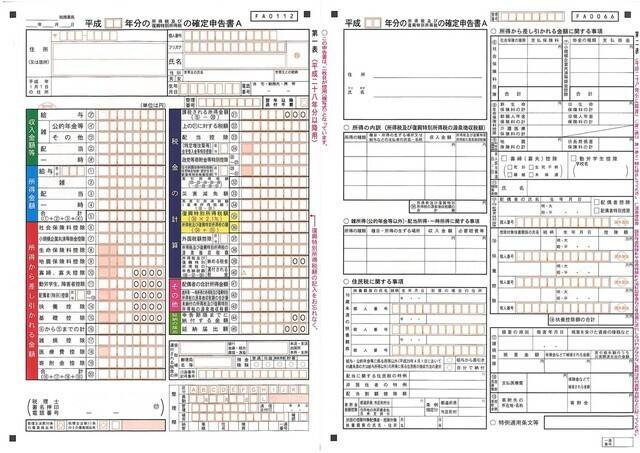

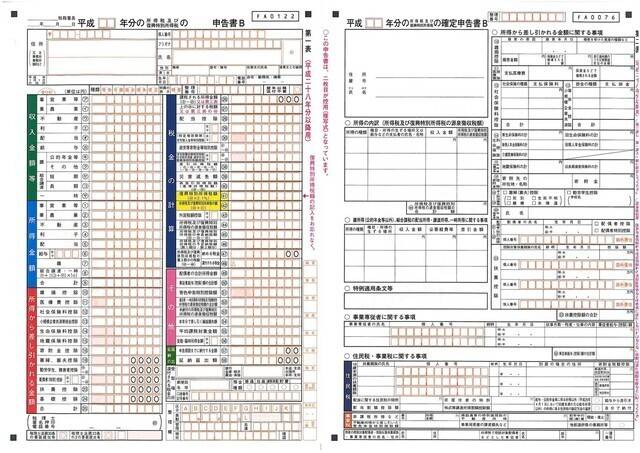

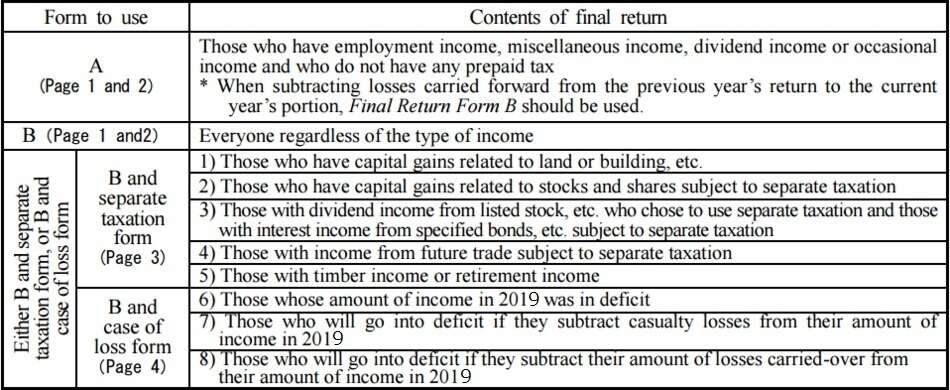

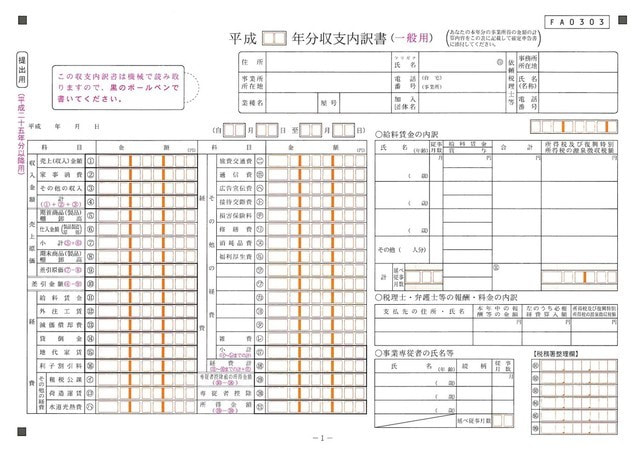

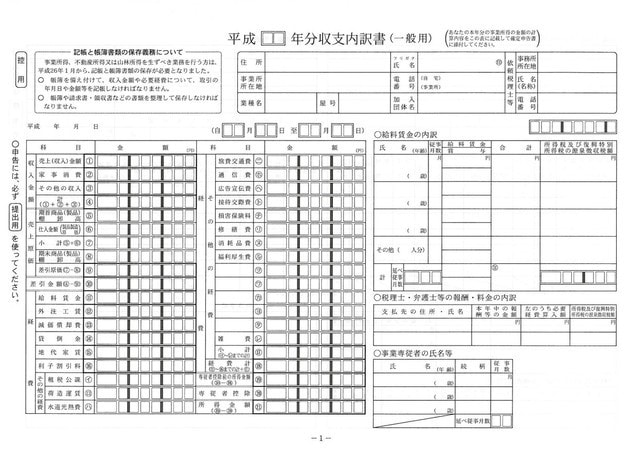

Those who are required to file a tax return must do so at the local tax office (Zeimusho - 税務署). Final Return FormsThe form refers to earnings and expenses for the previous calendar year, from January 1st to December 31st. In addition to calculating your taxable income, the form will be used to determine the rates you pay for residence tax and health insurance. By filing the tax return, certain individuals who overpaid in tax may qualify for a rebate. Examples include those who changed jobs or had a period of unemployment during the previous year, paid over 100,000 yen in medical fees, made charitable donations or who suffered losses as a result of an accident or crime. Basically, there are two types of final return form; Form A and Form B.

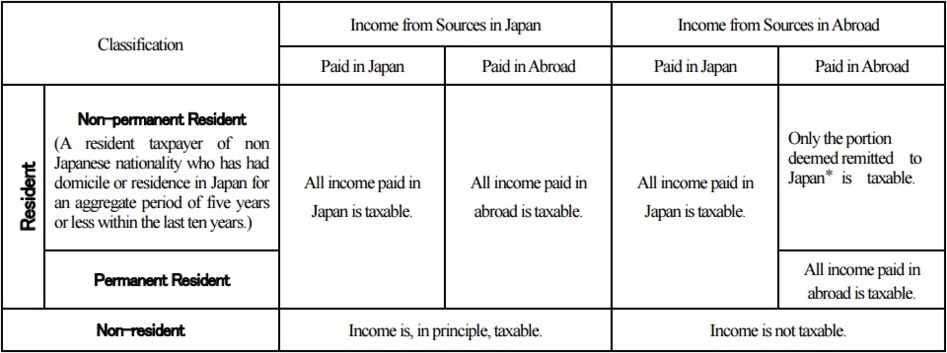

For tax purposes, foreigners living in Japan are classified into three categories:

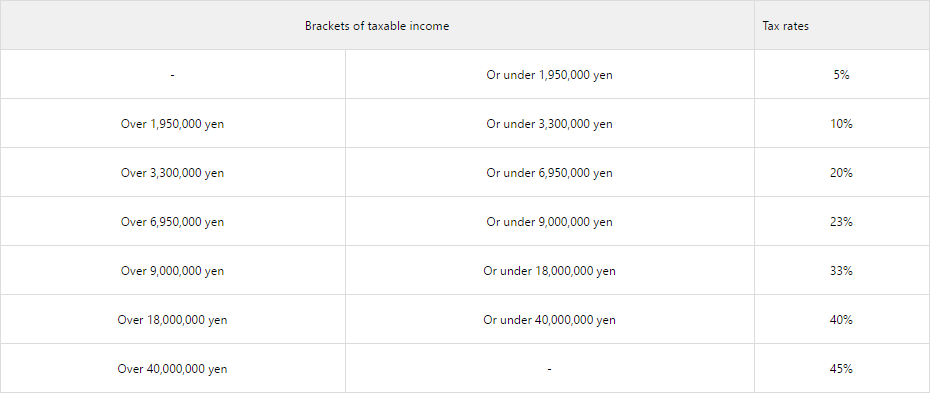

Note: Tax treaties between Japan and many countries can take precedence over the above guidelines. You can find the list of countries that have tax treaties with Japan on the Ministry of finance Japan Website. When To Pay TaxesThe filing period for final tax return of the previous fiscal year "January 1st to December 31st", is from February 16 to March 15. For example, if you have to pay national income taxes for 2019, the payment should be done by March 15, 2020. Note: When a taxpayer files his or her return after the statutory due date of filing return or fails to pay tax by the due date of tax payment, the additions to tax will be imposed on the principal tax. Tax RatesThe tax rate is calculated based on the taxable income, which is the total earnings minus exemptions for dependents and different types of deductions, such as deductions for medical expenses and business expenses of the self-employed individuals. For more information visit National Tax Agency Japan Website. How To File Tax ReturnYou can file your tax return through any of the following ways.

Documents Required To Submit When Filing Final ReturnAs a result of the introduction of the social security and tax number system "My Number System", those who submit a final return need to write their Individual Number in their final return for fiscal 2016 and onward. In addition, when submitting the final return, it is required to present your identification document/passport or attach a copy of such document to the forms, bankbook, Inkan "if you have one", and "Withholding Statement", along with any other documents showing any other sources of income. For an exemption for overseas dependents, proof such as a birth certificate or a marriage certificate along with bank transfer statements are required. For an exemption on medical expenses, all medical statements and receipts are required. For those who purchased a house, all relevant loan documents are required. For more information about filing final returns, visit your local tax office. Note that during the tax season, free consultation is offered at the tax-office, by staffs, in several languages. They would also help you to fill out the forms. Use the Japan Tax Calculator to quickly get an idea of the amount of taxes you might have to pay. Related Reading:

2 Comments

6/24/2022 06:42:19

Students! Once you place your order, we link you with a qualified online research paper writer to tackle your assignment. Depending on your deadline, you will receive your work within the shortest time possible. Forget about restless nights and late submissions because we guarantee prompt deliveries without fail.

Reply

Leave a Reply. |

Halal In Japan

|

|

RSS Feed

RSS Feed